|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Intricacies of Pet Health InsuranceIn an era where pets are increasingly regarded as integral members of the family, the concept of pet health insurance has gained significant traction. This burgeoning industry offers a safety net for pet owners, cushioning the blow of unexpected veterinary expenses. Pet health insurance, much like its human counterpart, provides a financial safeguard, ensuring that furry companions receive the necessary medical attention without imposing undue financial strain on their caregivers. At its core, pet health insurance aims to mitigate the high costs associated with veterinary care, which can often be exorbitant. This coverage typically includes accidents, illnesses, and in some cases, preventive care. The appeal of pet insurance lies in its promise of peace of mind, allowing pet owners to prioritize the health and well-being of their beloved animals without constant worry about the financial implications. However, navigating the myriad options available can be daunting. The market is replete with various plans, each offering different levels of coverage and benefits. Some policies focus on comprehensive coverage, including everything from routine check-ups to major surgeries, while others may be more limited, covering only accidents or specific illnesses. When considering pet insurance, it is crucial to evaluate the fine print. Pet owners should pay close attention to exclusions, waiting periods, and the percentage of costs covered. Additionally, the age and breed of the pet can significantly influence the cost and availability of insurance plans. For instance, certain breeds predisposed to specific health issues may incur higher premiums or face exclusions for those conditions. One cannot overlook the potential drawbacks of pet health insurance. While it offers significant benefits, the monthly premiums can accumulate, especially for policies with extensive coverage. Furthermore, some plans operate on a reimbursement basis, requiring pet owners to initially cover costs out-of-pocket before being reimbursed, which can pose a challenge for those without ready access to funds. Despite these challenges, the popularity of pet health insurance continues to grow, driven by the increasing costs of veterinary care and the deepening emotional bonds between pets and their owners. The peace of mind afforded by knowing that a beloved pet can receive prompt and appropriate medical care cannot be overstated. In conclusion, pet health insurance represents a valuable investment for many pet owners, offering both financial security and emotional reassurance. As with any significant decision, it is essential to thoroughly research and assess individual needs and circumstances. Ultimately, the choice to invest in pet health insurance is a personal one, influenced by the desire to provide the best possible care for our cherished animal companions. https://idoi.illinois.gov/consumers/consumerinsurance/pets.html

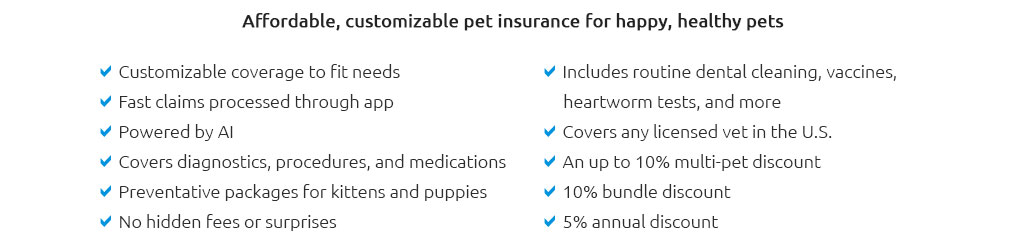

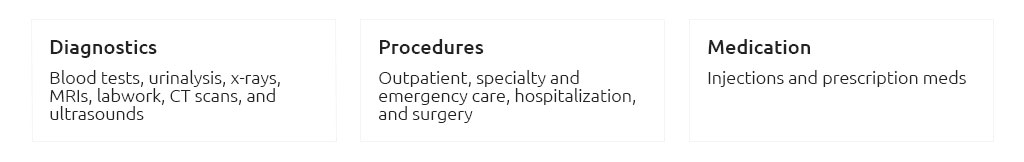

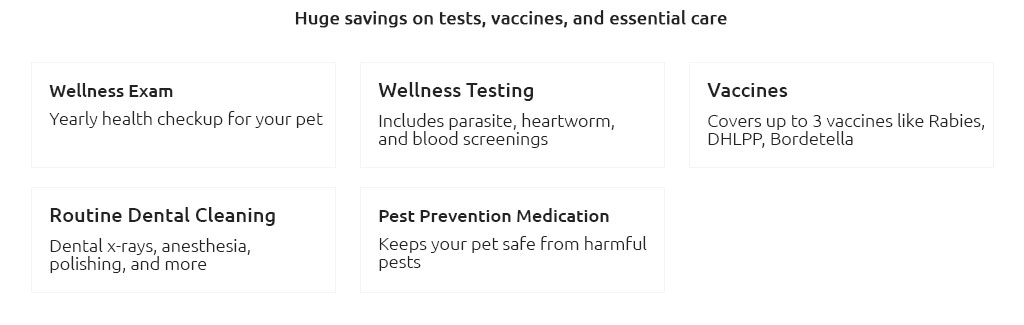

Pet health insurance typically protects you from financial losses when your pet gets into an accident or becomes ill. https://www.petco.com/shop/en/petcostore/insurance

Discover comprehensive coverage and peace of mind for your furry friend with Petco's Pet Health Insurance. Get customizable plans, reliable protection, ... https://www.chewy.com/pet-insurance/

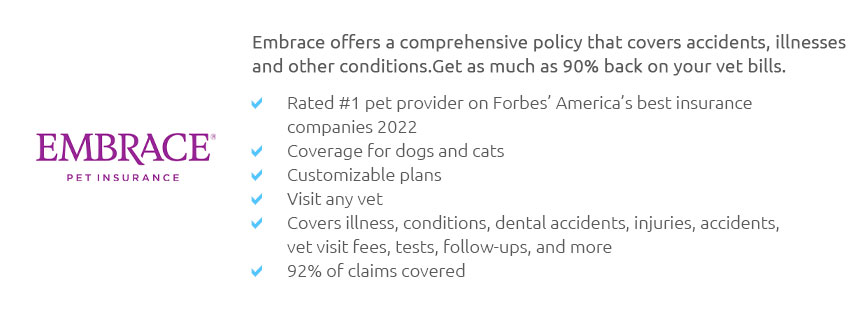

CarePlus is Chewy's pet wellness and insurance brand that has curated these plans for you. Trupanion is one of our program partners and an affiliate of the ...

|